Africa’s public debt is actually lower than in other world regions

In absolute terms, Africa's public debt is lower than any other world region but Oceania. The total debt stock owed by all African governments equates to over $1.8 trillion. Germany alone has a greater debt stock than this at $2.9 trillion. Even adjusted for GDP, African debt does not stand out as being uniquely high with 49 African countries having lower public debt-to-GDP ratios than the US (122.2%) in 2023. Japan (258.2%) and Greece (166.0%) have higher public debt-to-GDP ratios than any African country.

Yet eight of the nine countries listed by the IMF as being in ‘debt-distress’ in 2023 are African. This is because structural factors make debt uniquely burdensome for Africa.

World regions: share of total global public debt (2023)

African public debts are mainly held by non-African lenders and in foreign currencies

African countries' public debts are uniquely burdensome, in part because they are mainly owed to international rather than domestic lenders, making debt harder to refinance or restructure. Of the 10 African countries with data on creditor residency, seven owe more than half of public debt to overseas creditors. By contrast, over 70% of public debt in Canada, China, the UK and US is owed to domestic creditors.

External lenders prefer to lend to developing countries in their own currency or international ‘hard currencies’ (e.g. US dollar or Euro). Foreign currency debt carries an exchange rate risk. Industrialised countries usually borrow in their own currencies e.g. In the UK (£), China (CN¥), Canada (C$), and the US (US$) over 98% of central government debt is denominated in the local currency. By contrast, over 70% of Africa’s total public external debt is US dollar denominated.

Africa: currency of public external debt (2021)

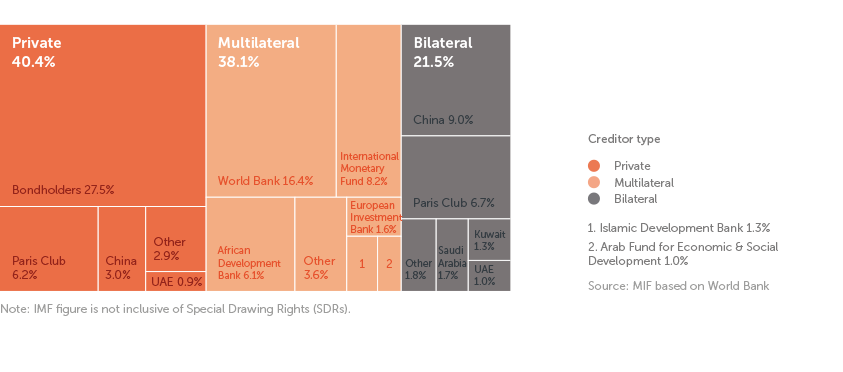

Most debt is owed to private sector creditors, who charge African countries higher interest rates

In 2021, more than one third (40.4%) of Africa’s public external debt was owed to the private sector. Post-2008 private sector lenders made more credit available to Africa in order to obtain higher returns than the low rates on offer in the Global North following the financial crisis.

Private sector lenders, primarily motivated by financial considerations, lend at market rates considerably more expensive than rates offered by official creditors. Many African governments for their part were keen on private credit, motivated by the desire to reduce dependence on aid or policy-conditioned loans from official creditors.

However, the amount African countries must pay to borrow from the private sector is largely determined by Western rating agencies. The ‘big 3’ rating agencies - Fitch, Moody's and Standard & Poor's (S&P) - are all headquartered in London or New York and only have two offices in Africa between them, both in Johannesburg. They have faced accusations of overstating the risk of lending to African countries. The African Union (AU) is moving forward through the African Peer Review Mechanism (APRM) with a plan to establish an African Credit Rating Agency as an independent entity to provide alternative and complementary rating opinions for the continent.

Africa: creditors of public external debt (2021)

Debt servicing costs rise as continent hit by multiple crises

The combination of multiple crises such as climate change, COVID-19 and Russia's invasion of Ukraine have led many African countries to struggle with debt sustainability. Between 2010 and 2021, external debt servicing payments in Africa have more than quadrupled, growing at over 60 times the pace of average fiscal revenues.

The crisis has led to calls for creditors to provide relief measures, but Africa’s myriad of creditors makes this a challenge. Getting all relevant actors around the same table has proven difficult. Private creditors have been reluctant to participate. Over half of servicing payments due in 2021 were made to private creditors. More than one quarter were owed to private bondholders, the overwhelming majority of which are governed under English or New York law.

Find out more in our: